Financial Advice for Newlyweds: Building Your Future Together

At BET Co-operative Credit Union Ltd, we believe that strong relationships are built on trust—and that includes financial trust. As newlyweds start their journey together, open and honest conversations about money can lay the foundation for a secure and successful future.

Here are four key pieces of financial advice for couples starting their life together:

1. Talk About Your Family Financial History

The way we handle money often starts with how we saw it growing up. Did your partner’s family talk openly about money, or was it kept private? Were they taught to budget, or did they figure things out as they went? These chats help you understand each other better and work as a team.

2. Be Honest About Your Debt

Transparency is essential. Whether it’s a student loan, credit card balance, or car loan, being honest about your debts help you plan how to pay it off together and avoid any surprises.

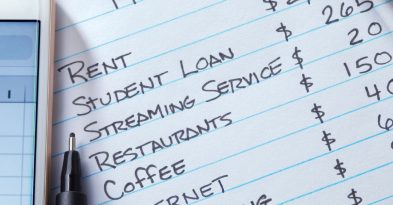

3. Create a Budget Together

A shared budget helps you take control of your money together. List your income, expenses, and savings goals to see where your money is going. At BET Credit Union, we can help you set financial goals and find products like savings accounts or term deposits to support your plans.

4. Start an Emergency Fund

Life doesn’t always go as planned. Having money set aside for unexpected costs—like car repairs or medical bills—can give you peace of mind. Start small if you need to. What matters is getting started.

BETCUL Is Here to Help

Whether you’re saving for a home, joining finances, or just figuring it out as you go, we’re here to help. BET Co-operative Credit Union offers friendly advice and smart financial tools to help couples grow stronger together.

Let’s build your future, together.