Buying a home is one of the most exciting — and significant — decisions you’ll ever make. It represents independence, stability, and a new chapter in your life. But before you sign on the dotted line, it’s important to understand that home-ownership involves more than just making mortgage payments.

At BET Co-operative Credit Union Ltd, we want to help our members make informed, confident choices. Here’s what to consider when budgeting for your new home:

It’s More Than a Mortgage

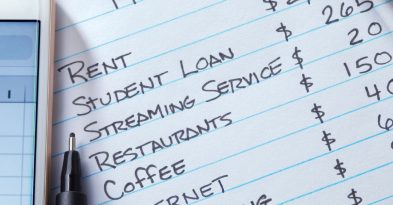

Many first-time homebuyers focus solely on the mortgage payment. While this is a major component of your monthly cost, it’s far from the only one. A well-planned budget includes all the hidden or additional costs that come with owning a home.

Factor These Into Your Budget:

Property Taxes : Annual property taxes can vary significantly depending on the value and location of your home. Be sure to research your area and include these in your monthly estimates.

Insurance : Home insurance is essential for protecting your investment. Your lender may require specific coverage, so it’s important to know your policy options and costs.

Maintenance & Repairs

From plumbing issues to roof repairs, home maintenance is unavoidable. Set aside funds monthly to cover both routine upkeep and unexpected repairs.

Utilities & Additional Costs

Don’t forget to include monthly utility bills, monthly home maintenance i.e lawn & garden upkeep

.

Plan Smart. Live Secure.

Owning a home is a big step — but with careful planning, it can be one of the most rewarding investments you’ll ever make. Our team at BET Co-operative Credit Union Ltd is here to help you navigate the mortgage process and build a realistic budget that supports your financial well-being.

Ready to start your journey to homeownership? Contact us today and let’s make your dream home a reality.